Choosing the Right Health Insurance as Retired Travelers

As full-time retired travelers, navigating health insurance can feel daunting—what do you need to know to stay protected on your adventures? One of the most common questions we receive is about how to choose the right policy. Good coverage and affordability were our top priorities when selecting health insurance for our travels. After extensive research, we opted for the CIGNA Global Health Silver policy, which we’ve had for nearly two years. Here’s a summary of what the coverage includes. This established and reputable insurer provides us with confidence that if we need to access our policy, it will be there for us.

Understanding Health Insurance vs. Travel Insurance

As U.S. citizens under age 65, we aren’t eligible for Medicare and we don’t have any private U.S.-based health care coverage. Since we are retired, we aren’t part of any employer insurance program. So when we began looking for health insurance, we focused on options that cater specifically to full-time travelers living abroad. Unlike travel insurance, which typically covers issues like lost luggage or trip cancellations, we were searching for a policy that protects against severe health issues, such as a cancer diagnosis. It’s crucial to take into account the coverage that is most important to you when reviewing quotes.

In the next section, we will provide a detailed look at our policy, including coverage specifics and costs. If you have any questions or experiences with travel health insurance, we’d love to hear from you in the comments!

The Cost of Coverage

For both Kevin and me, the total premium we pay is $5,781 annually, which covers both of us. By paying in full at the time of purchase or renewal, we save 10 percent over what it would cost with monthly premiums. Age will play a role in the pricing. As of the time of our renewal in January, I was 59, and Kevin was 61. This price is an increase of $29.36 from what we paid in 2023, which is a negligible increase.

Understanding Our Deductible and Coverage

Kevin’s hernia repair in Serbia was fast and efficient

Our plan includes a $3,000 deductible, which we feel is worth it. Our goal is to protect ourselves from catastrophic health issues rather than expecting to use it for every little ailment. This approach allows us to save significantly on our premiums while still having a crucial safety net in place.

One limitation of this plan is that the policy only covers emergency care within the U.S., and the person needing care must be treatment free, symptom, and advice-free of the medical condition before traveling to the U.S. We could have added regular coverage to the U.S., but the premiums would have been significantly higher. We typically only travel to the U.S. for three weeks per year, so this limitation isn’t a significant obstacle to us. We know that healthcare in the U.S. is prohibitively expensive, and we believe we can get excellent care abroad. We may decide to pay for Medicare at 65, but for now this plan is a good compromise. This is a common limitation in nearly all the plans we reviewed. Including the USA as part of the policy could raise premiums by as much as 80%.

Real-Life Application: Surgery Abroad

Kevin’s required hernia surgery when we were in Serbia. He was able to secure an appointment over the telephone within two hours of his initial call, have all surgery prep that afternoon, surgery that evening, and be released late the next afternoon. His providers spoke clear English and all the costs were spelled out upfront. The total price for the procedure came in at under $2,000. You can learn more about our experience by watching our video, “Surgery in Serbia.” This experience reassured us that care outside of the U.S. can be much cheaper while still being of high quality, making our CIGNA coverage actually quite sufficient.

Medical checkups at Chiang Mai Ram Hospital

We also have gotten comprehensive medical exams while in Chiang Mai, Thailand. The process there was thorough, straightforward, and well managed for us. We needed some followup appointments because of a few potentially concerning results, and those were scheduled for the same day and we received results for nearly everything the very next day. I also needed a skin biopsy, which fortunately was negative, and I received those results within a week. The entire process was professional and the care was excellent. We share our experience from Chiang Mai Ram Hospital in this video, Medical Checkups in Thailand.”

Comparing Options and Adjustments

When we first spoke to a CIGNA insurance agent, we were quoted for the Platinum policy, which is much more expensive policy and the quote also had a lower deductible. However, this quote was nearly double the cost of our current plan. We obviously didn’t take that plan and worked with our agent to toggle a few numbers in order to get us to the plan we have with a $3K deductible. This is a reminder that you can often adjust your coverage based on price points you’re comfortable with—so don’t hesitate to be specific about your budget.

Another limitation for us was my history of basal cell carcinoma, which occurred the year prior to starting our travels. This became an exclusion on our policy, meaning if I need further treatment for it, it won’t be covered. While this could be a significant concern for some, it wasn’t a dealbreaker for us given our overall health. Most companies will go through an underwriter review process and there is a chance they will exclude pre-existing conditions, except for Safety Wing, which automatically will not cover pre-existing conditions at all.

Looking at Alternatives

We looked at several other plans besides CIGNA but rejected them for a variety of reasons. IMG’s Resident Silver plan offers a higher policy limit and a lower deductible, but it costs $567 more than CIGNA. It might be worth investigating further and understanding what additional benefits it offers to see if it’s worth the extra $47.25 per month when our policy is up for renewal in January. For now it’s worth keeping the policy we have because I’ll be 60 this year and there is a bump in premiums when you leave the 50-59 age bracket. IMG has an age limitation, unlike CIGNA, but it also doesn’t exclude coverage in the U.S., which could be a big perk for some people.

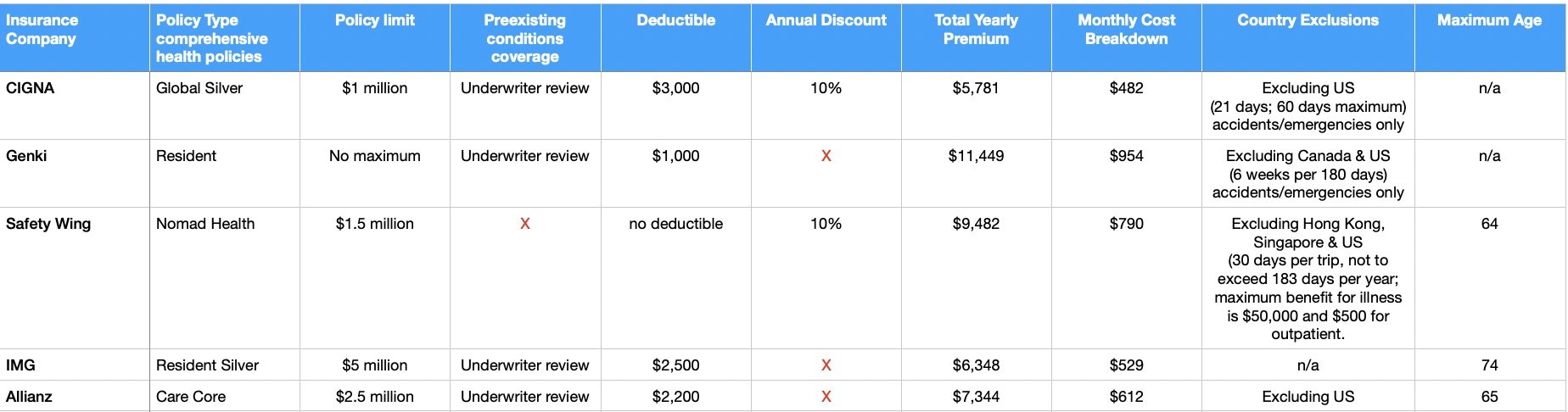

Here’s a breakdown of our findings:

Breakdown of insurance providers for global healthcare, not only emergency health travel insurance

I want to point out that Safety Wing has a Nomad Insurance policy that can provide up to 364 days of coverage, and then you need to renew, which means that you don’t have continuous coverage. You can get this coverage up to the age of 69, but it’s a very different policy from Nomad Health. On paper it looks like a cheap, robust policy, but on deeper analysis, if you get diagnosed with cancer or some other serious illness, the diagnosis would be covered, but chemo and other costs would not be covered. For us, that’s a huge gap in coverage and treatment that we aren’t willing to risk. Some people have mitigated this issue by having a concurrent ACA (Affordable Care Act) policy in the US that’s based on your income. However, you need to factor in the cost of travel to the US and accommodations and a rental car into this equation. For some, this combination might make it worthwhile to get healthcare in the US for issues that aren’t covered under many of the policies. We’d prefer to get our healthcare on the road versus going back to the US for it, so this isn’t an option we’re using.

Final Thoughts

While health insurance may not be the most fun part of the planning process for full-time travel, it is an essential aspect of living abroad as a U.S. citizen. We’re happy with our choice of CIGNA Global Health Silver, as it meets our needs for coverage overseas without breaking the bank. Safe travels and stay healthy!

If you found this article helpful, don’t keep it to yourself! Share it with fellow travelers who might need guidance on health insurance options.